Learn: Investing Fundamentals

This page introduces the core ideas that help new investors build confidence and focus on long-term outcomes.

Inflation and why investing matters

Inflation reduces the purchasing power of your money over time. Even when prices rise slowly, uninvested cash gradually loses value.

- Governments typically target an inflation rate of ~2%

- In 2021, inflation reached 6.8% in Canada and 7% in the U.S.

- Inflation is non-avoidable unless your investments outpace it

If inflation is 5%, you need returns greater than 5% simply to maintain purchasing power. Investing is not optional—it is defensive as much as it is growth-oriented.

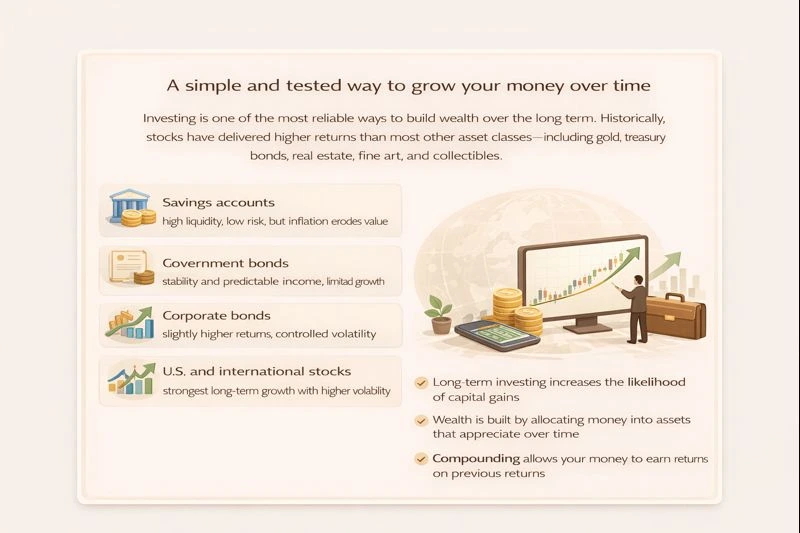

A tested and trusted approach for new investors: Index funds

Index fund investing is one of the most proven strategies for long-term wealth building, particularly for beginners.

- Historically delivers 8–10% average annual returns over long periods

- Passive approach designed to match, not beat, the market

- Compounding benefits become most powerful later in the investment timeline

Important reminder: Markets do not move in straight lines. Some years will be negative.

- S&P 500: −18% (2022)

- +25% (2023)

- +26% (2024)

Short-term volatility is normal. Long-term participation is what matters.

Time in the market beats timing the market

Time in the market consistently outperforms attempts to time market movements.

- Over most 20-year periods, U.S. stocks have shown no real negative returns when dividends are included

- Over 30-year periods, returns tend to converge despite short-term divergence

- The strategy is simple: continue investing regardless of market conditions

Consistency matters more than prediction.

Key definitions

Index

A group of preselected investments used to measure the performance of a market or sector. Examples: S&P 500, NASDAQ, Dow Jones.

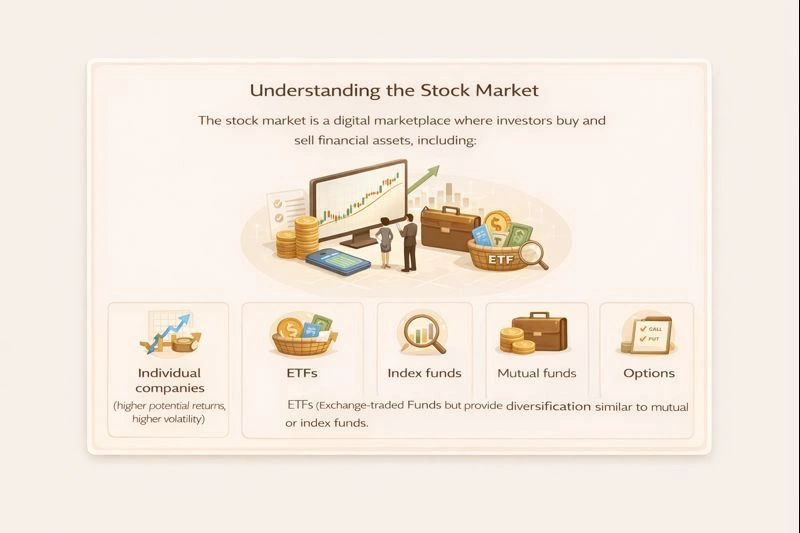

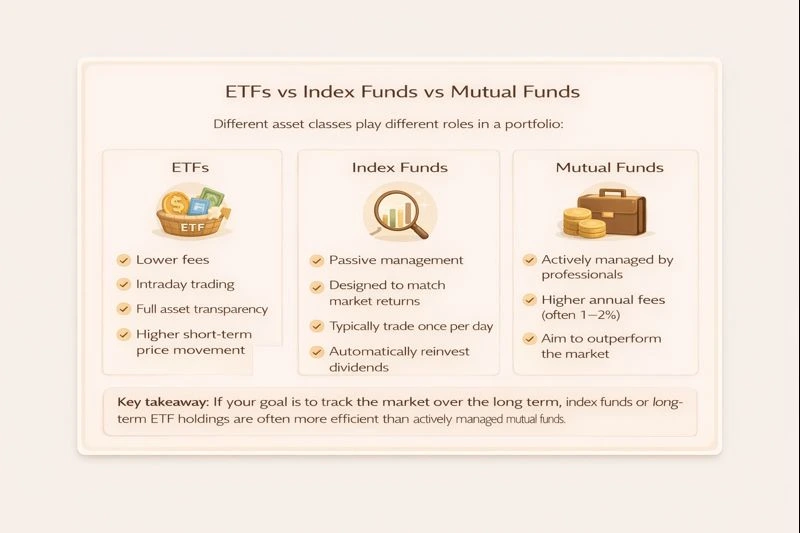

Index Fund

A fund that holds hundreds of leading companies and aims to track an index’s performance.

- Passive investment style

- Designed to match long-term market returns (8–10%)

ETF (Exchange-Traded Fund)

An investment fund that holds multiple assets (stocks, bonds, commodities).

- Trades like a stock on an exchange

- Provides diversification at low cost

Target Date Fund

A fund that automatically shifts from growth-focused assets to conservative assets as a target retirement date approaches.

- Starts stock-heavy

- Gradually increases exposure to bonds and cash

Treasury Bonds

Long-term fixed-income securities issued by the U.S. government.

- Provide regular interest payments

- Principal returned at maturity (typically 20–30 years)

- Essentially an IOU from the government

Understanding investing fundamentals

Revenue

Total income earned before expenses.

Net Income

Profit remaining after all expenses, taxes, and costs are deducted.

Price-to-Earnings (P/E) Ratio

The price investors pay for $1 of a company’s earnings.

- Higher P/E can indicate optimism or high growth expectations

- Lower P/E may indicate undervaluation or slower growth

- P/E ratios vary significantly by sector

Price-to-Sales (P/S) Ratio

Shows how much investors are willing to pay for each dollar of revenue.

Free Cash Flow

Cash remaining after operating expenses and reinvestment.

- Positive free cash flow generally signals financial strength

- Not directly applicable to banks due to regulatory differences

Founder-led companies

Businesses still led by their founders, often associated with long-term vision and aligned incentives.

Building a portfolio based on risk tolerance

Different asset classes play different roles in a portfolio:

- Savings accounts: high liquidity, low risk, but inflation erodes value

- Government bonds: stability and predictable income, limited growth

- Corporate bonds: slightly higher returns, controlled volatility

- U.S. and international stocks: strongest long-term growth with higher volatility

The three-fund portfolio (long-term framework)

- 60% U.S. market index fund

- 30% international market index fund

- 10% bond market index fund

Markets are volatile both individually and collectively—diversification helps manage that risk.

Time in the market beats trying to time the market.

Consistency, patience, and clarity are more powerful than prediction.